We’ve all shopped online a little more of late, and that’s had a massive impact on the future of eCommerce.

According to several studies, the pandemic has rapidly accelerated the shift to online shopping.

Data from IBM’s U.S. Retail Index suggests the pandemic accelerated the shift away from physical stores to online shopping by about five years. At the same time, department stores are facing a steep decline. While eCommerce will grow by 20% in 2020, department stores will decline by more than 60%.

In the U.K., Edge Retail Insight estimates online sales will grow 19% year-on-year, up from a pre-pandemic estimate of 11%. That will see the value of total online sales increase by more than £10 billion. Amazon is the big winner here and could see sales rise by £2 billion.

In fact, Amazon has performed so well during the pandemic that the company is adding 7000 permanent U.K. jobs to deal with surging demand.

British retailers have also been quick to respond to growing demand in online shopping. A whitepaper study by Barclays Corporate Banking found 15% of retailers have created roles to deal with increased online sales. A third (33%) of retailers have invested in upgrading their websites during the lockdown, 32% have accepted new payment methods, and 26% have started to use data analytics for the first time.

Grocery growth is particularly strong

While the eCommerce sector has grown as a whole, some categories have proved more popular than others.

A report by Forrester, which predicts eCommerce will increase by 18% to the end of 2020 across Europe’s five largest economies, expects groceries to growing fastest at 42%. Health and personal care are second at 31%.

No one who tried to book a Tesco delivery slot during the pandemic will doubt those figures. Just about every U.K. grocery retailer has seen a surge in demand that many expect to become permanent.

Ocado has reported a 27% rise in half-year revenue and a doubling of retail profit. In the hour immediately following the lockdown announcement, as many shoppers visited the Ocado website as had done during the entire previous quarter. Even now, Ocado has over 1 million people on a waiting list to become customers.

Asdas reported a doubling of online sales in the quarter following the pandemic. Tesco online sales grew 48% during the lockdown. Sainsbury’s saw online sales rise 87%, with CEO Mike Coupe saying he thinks the habit will stick. Even Aldi has launched an online grocery service.

What’s caused online shopping growth?

The pandemic has caused a massive surge in online sales in several ways.

Closed stores force shoppers online

In many cases, consumers have been forced to shop online or not shop at all. In countries everywhere, lockdowns meant all non-essential stores were closed. If you wanted new pyjamas to work from home in or a new board game to pass the evenings, you probably had to buy it online.

Fear of the Virus

Even in cases where stores were opened — like the grocery sector — many consumers preferred to shop safely from their own homes rather than face crowded stores and risk catching the virus.

A superior shopping experience

It’s one thing to be forced to buy something online, and it’s another to enjoy it enough to want to do it again. Where the coronavirus caused virgin eCommerce shoppers online, the superior digital shopping experience has convinced many to stay.

The added convenience

Shopping online wasn’t just safer during the lockdown; it was more convenient than ever. Remote working meant consumers were guaranteed to be at home when packages were delivered. Products that previously could have been purchased during lunch breaks or after work can now be ordered online just as conveniently.

Is this shift temporary?

It seems unlikely things will ever go back to the way things were — that’s according to data, at least.

Almost half (42%) of the 1,033 UK consumers surveyed by ChannelAdvisor and Dynata said they would shop online more frequently post-lockdown.

This is supported by research from O2 Business and Retail Economics who report 44% of U.K. consumers will permanently change the way they shop, and 47% of consumers think they will definitely shop online more in the future.

Add to that data from McKinsey & Company, which shows there has been a 50+% growth in the number of U.K. consumers who expect to make grocery purchases online post-pandemic.

While the growth of online shopping probably won’t slow, the rate at which growth occurs perhaps will.

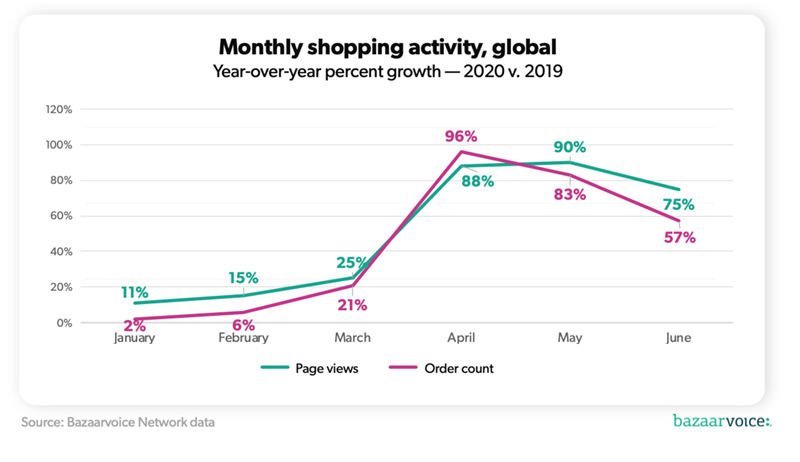

Online shopping activity is already falling from peak levels in April and May. Data from Bazaarvoice shows page views in June were up 75% YOY, down from 88% in April and 90% in May. YOY order growth similarly fell in June, down 57% from a high of 96% in April. Nevertheless, both figures are significantly higher than January’s YOY growth figures of 11% for page views and 2% for orders.

Adobe noticed a similar slowdown in growth after stores reopened in the U.S. in July. Sales were still up 55% YOY in July, but this was a significantly smaller decrease than June’s YOY growth of 76%.

That being said, growth in the U.K. has continued to accelerate. The latest Online Retail Index from IMRG and Capgemini found online retail sales grew 33.9% in June (a 12-year high since March 2008) and 3.5% higher than May’s figure.

Whether the acceleration is temporary or not, the growth of eCommerce is all but assured. It’s not just enough to have an online store anymore. When a third of retailers are upgrading their website, and a quarter is starting to use data analytics, delivering an exceptional online shopping experience is vital if retailers want to survive in the new world.

—–

Ed Currington is a freelance copywriter and content marketer for B2B tech, eCommerce and marketing companies. He specialises in long-form content.