Google has announced it will be passing on the costs of the new Digital Service Tax (DST) to advertisers.

Earlier this month, the search giant said advertisers on Google UK and YouTube will be charged the 2% digital service tax on top of their usual ad spend starting on 1st November.

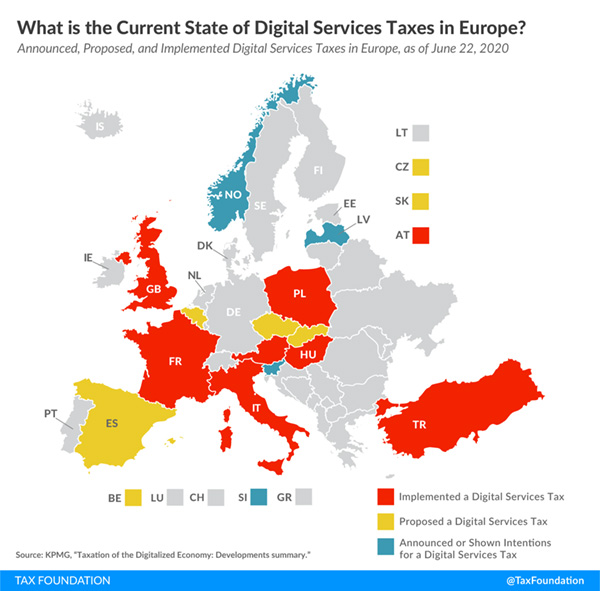

It’s not just British advertisers who are being forced to swallow the costs. Advertisers in Austria and Turkey will need to pay a 5% tax if they continue to advertise on the search engine in both countries.

While some will see this as another way for Google to avoid tax, the search engine argues the costs of these kinds of taxes are typically worn by customers. Speaking to City A.M., a Google spokesperson said:

“Typically, these kinds of cost increases are borne by customers and like other companies affected by this tax, we will be adding a fee to our invoices, from November.

We will continue to pay all the taxes due in the UK, and to encourage governments globally to focus on international tax reform rather than implementing new, unilateral levies.”

What does this mean for advertisers?

In short, it will mean it’s even more expensive to advertise on Google.

But it will also make advertising more complicated for brands, too. The new digital service tax is set to be levied on top of an advertiser’s monthly budget. It will be added as a separate line item on their invoice rather than being dedicated from the budget set in Google.

This sounds sensible on the face of it. After all, digital service tax is charged against revenue, which in Google’s case is the total ad spend. But by charging the tax separately, ad-based performance metrics like CPCs and conversion costs won’t take the additional expense into account. Advertisers will need to factor in the cost of the tax when assessing return on ad spend and other ROI metrics, too.

It’s not just advertising costs that will be impacted. If retailers rely heavily on Google ads to generate sales, they will also need to assess the impact of the tax on product margins. Some advertisers may have products that are no longer worth advertising on Google when the 2% tax is taken into account.

The only saving grace for retailers is the falling CPCs many have seen on the platform during the pandemic.

Wasn’t it inevitable the tax would be passed on?

Many have argued exactly that since it was first proposed by former Chancellor Phillip Hammond in July 2019.

Phil Smith, Director General of ISBA, said:

“While this is disappointing news for our members, it is the inevitable outcome of the UK’s unilateral approach to digital taxation. We have been consistent in warning the government of the potential consequences of this approach, including the risk of an increase in costs to advertisers in the UK market.

“With further headwinds from government hitting the advertising sector in the coming years, it’s time the government proved that they recognise the importance of the sector to the economic recovery.”

David Jinks, Head of Consumer Research at ParcelHero has also consistently warned about the impact of the tax on advertisers. In the wake of Google’s announcement, he said:

“The news that Google is passing on the cost of the new Digital Services Tax to Google and YouTube advertisers is nothing less than a kick in the Googlies to British shoppers who will, of course, ultimately pay the price. Online sellers need to spend money on Google Ads to keep their products visible. Some companies spend many thousands of pounds a month on ‘pay per click’ (PPC). Every time a shopper clicks on a Google advertising link the seller is charged a fee and the new DST payment will be added to this bill.”

He also warns it’s probably the consumer who ultimately pay the cost:

“For example, a UK advertiser who spends £6,000 on Google for clicks in December will pay an additional £120 (representing 2%) in DST fees. That will make their final bill £6,120 plus VAT. In all likelihood, that £120 will be passed on to their customers through an increase in prices.”

What is the digital service tax?

The Digital Services Tax was introduced in April 2020 after a great deal of discussion in Europe and the U.S. on how to effectively tax big tech companies.

The UK tax will be levied against any firm with annual global revenue from digital services that exceeds £500 million, with more than £25 million from UK users. In other words, Google, Facebook, Twitter and Amazon.

The concept of a DST was agreed with other European countries, with the specifics of the tax left to individual countries. France announced a 3% tax in July 2019 but suspended the collection of the tax earlier this year to avoid increased tariffs from the U.S.

Austria and Turkey are levying a 5% tax, hence the increased fee for advertisers in those countries.

Source: Tax Foundation

Will advertisers foot the Billon other platforms?

Yes. From September, Amazon is increasing the fees it charges UK third-party sellers by 2%. This includes referral fees, FBA fees, monthly FBA storage fees and MCF fees. It has also committed to raising sellers’ costs in any other country where it is charged a similar tax.

Apple has also changed how it handles fees from the UK App Store, with 22% going to the UK government (VAT + DST) and the rest split between Apple and the developer.

Facebook is yet to announce but it is widely expected to follow suit.

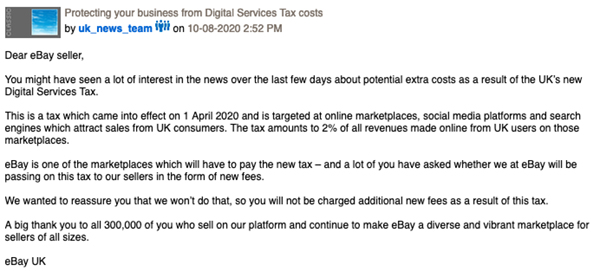

Only eBay has announced they will pay the digital service tax themselves.

Multichannel ecommerce marketing is more important than ever

With advertising fees set to rise on almost every digital platform, brands must adopt a multichannel digital marketing strategy going forward. When you rely on one marketing channel to drive the bulk of your conversions, you are beholden to their actions. A small increase in costs can leave your business model in tatters.

If Google’s move has you rethinking your marketing strategy then let’s talk. As a results-driven, full-service eCommerce agency, we can help you launch integrated multichannel campaigns that drive conversions and grow your store.

Get in touch to find out more.

––––––

Ed Currington is a freelance copywriter and content marketer for B2B tech, eCommerce and marketing companies. He specialises in long-form content.