This season promises a Christmas shopping period like no other.

With an English lockdown in force until at least the 2nd December and consumers already used to making online purchases during the pandemic, retailers look particularly well placed to have a stellar Christmas shopping season and end to the year.

A golden fourth quarter is not a given though. Your store needs to be prepared to handle everything that this season’s unique holiday shopping period throws at it.

Here are the four top 2020 Christmas shopping trends we think eCommerce brands need to be aware of.

Festive sales Willstart earlier this year

If you haven’t already opened your Christmas shopping store, you’re already behind.

Consumers have already been thinking about gifts for months according to research by Google. Last year, almost a quarter (22%) of consumers were thinking about purchases three to six months before the big day. This year, consumers are expecting to buy even further in advance.

To that end, Black Friday is becoming Black November. The sales have already started at many of the UK’s biggest retailers.

Both John Lewis and Marks & Spencer launched their online Christ stores early this year after noticing exceptional demand for festive products. John Lewis opened their store in August, ten days earlier than 2019 after searches for Christmas shopping products almost quadrupled compared to the year before. Searches for festive products at Marks & Spencer online store was up 80% compared to last year.

What can e-commerce brands do?

If you haven’t already launched your Christmas sales offers, start today. The longer you wait, the more you will lose out to competitors — especially when consumers are keen to buy presents well ahead of time.

More purchases Willhappen online

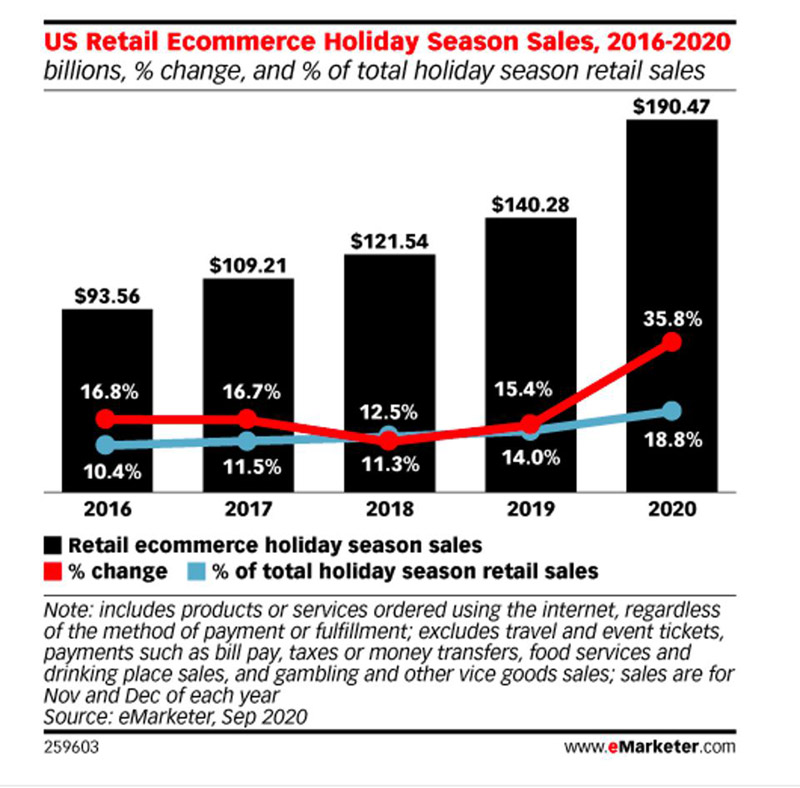

Virtually everyone is predicting an increase in online spending this festive season. Salesforce estimates up to 30% of US holiday retail sales will be made digitally. A survey by Bazaarvoice found 85% of retailers believe online sales will increase this year, and 61% expect higher engagement and more purchases through social media. In response, 55% of retailers are investing in upgrading their online store.

But theirs a flip side to higher online sales: the total amount spent in-store could fall as a result. A report by Vouchercodes.co.uk predicts consumers to spend £84.5 billion this year, equating to £1,206.19 per adult. In-store spending will decrease by 7% to £60.84 billion, while online spending will increase by 25.1% to £27.9 billion.

What can e-commerce brands do?

If your store is to drive a large percentage of purchases, it must be up to scratch. Most importantly of all, it must be fast and to continue to work under heavy server loads. Use a Content Delivery Network and Caching to improve website load times and increase the bandwidth on your servers to avoid crashes.

Last-mile delivery could be a headache for brands

Logistics and supply chains will be pushed to breaking point as online orders grow. In particular, long delays are expected when it comes to last-mile shipping.

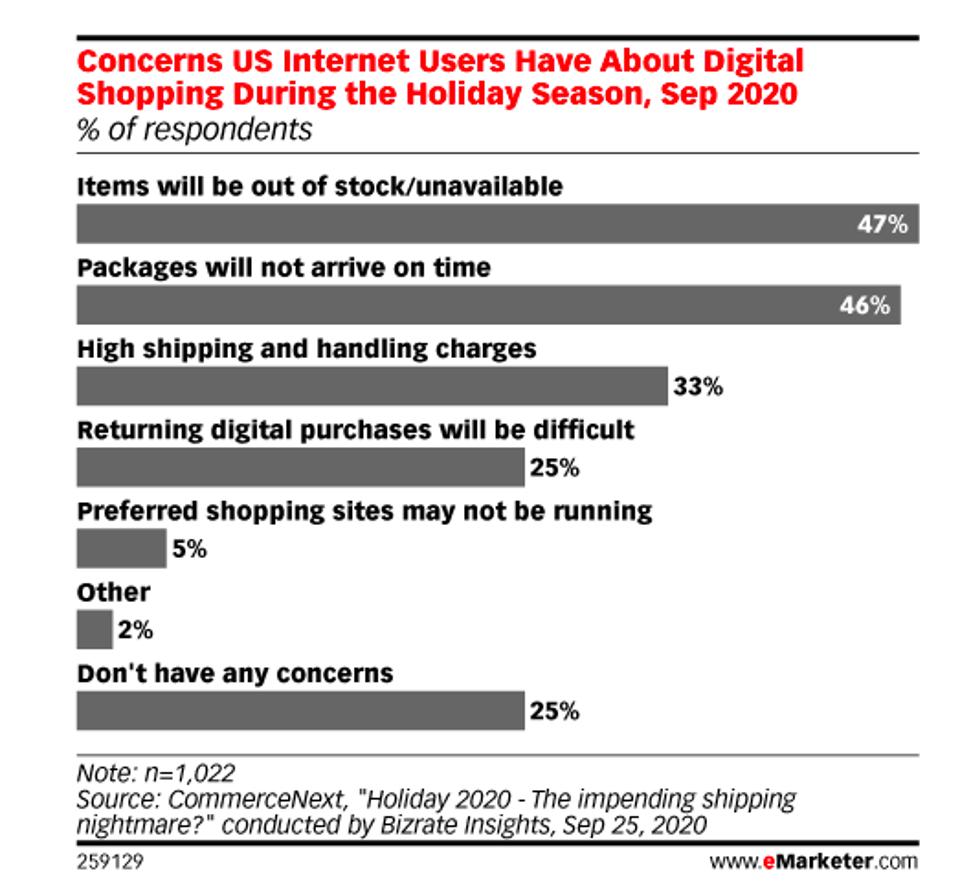

Many consumers are already familiar with this, having experienced delivery delays during the first lockdown. According to Citizens Advice, almost half (47%) of adults have experienced difficulties with online orders in the last six month.

Shipping couriers are well aware of the challenge. Mike Hancox, CEO of Yodel, says the company has been operating at “peak levels since March.” Volumes are up 20% year-on-year with Christmas expected to increase volumes by another 20%.

Big brands are already experiencing delays. Tesco’s website crashed after consumers flooded its online store trying to book a delivery slot in time for Christmas.

What can e-commerce brands do?

Your brand’s reputation is on the line if you fail to deliver a Christmas present. So be clear about in-time-for Christmas shopping delivery dates and encourage consumers to shop early. Make arrangements with multiple shipping carriers in case one provider lets you down.

Returns could be even more trouble in the new year

Higher online sales inevitably mean more returns. But January’s returns could shatter all records. According to research by eMarketer, eCommerce sales will reach $190 billion in November and December. But it estimates the value of returned items to be between $47 billion to $57 billion.

Returns may be particularly bad if you sell electronics or apparel. Research by Signifydfound return rates for these two verticals (already some of the highest in retail) rose by 80% during the pandemic.

What can e-commerce brands do?

Have a clear return policy in place and make it prominent on your site. If possible, allow consumers to return products to the store as well as through the post. Robust inventory management software will make managing the process significantly easier and help you get products back on sale as fast as possible.

Further, negate the need for returns by helping consumers choose the best product. High-quality photos, detailed product descriptions and customer reviews can all help to reduce return rates.

Returns may be the last thing on your mind. But, if you plan these trends on this list now, you’ll put your brand in the best position to finish the year on a high.

——–

Ed Currington is a freelance copywriter and content marketer for B2B tech, eCommerce and marketing companies. He specialises in long-form content.